Carson McQueen Klarna is the most popular app for online shoppers who want to purchase something without paying the full upfront price. But you should check out Klarna alternatives to widen your options and ensure that you’re getting the best deal from different vendors.

Apps Similar to Klarna

- Afterpay

- Sezzle

- Affirm

- Splitit

- Quadpay

- ViaBill

- Zebit

- Perpay

- PayPal Credit

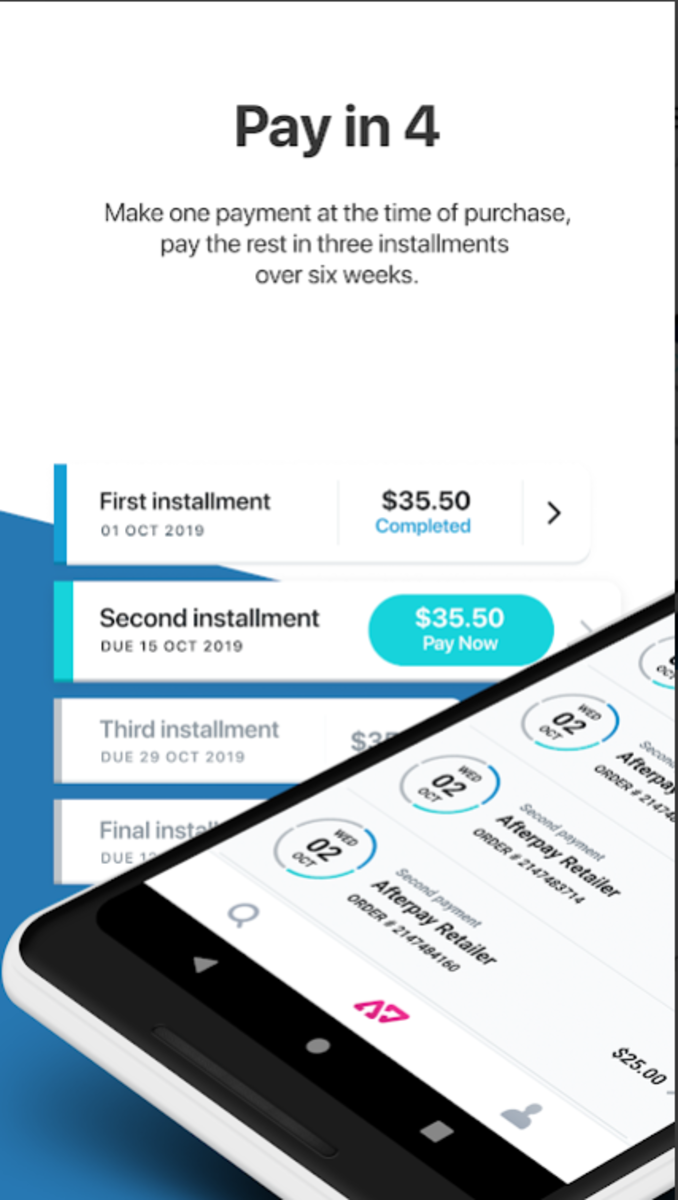

1. Afterpay

Afterpay shares many similarities with Klarna. This app allows you to go online shopping and pay for your goods in four equal installments. The installments are paid every two weeks, giving you plenty of time to sort out your finances and pay on time. One of the best things about the app is that it has partnered with more than 12,000 vendors. Just imagine the sheer volume of items you can purchase. It’s worth noting, however, that getting approved or rejected is done on a per-purchase basis. To increase your chances of getting approved, be sure to make timely payments.

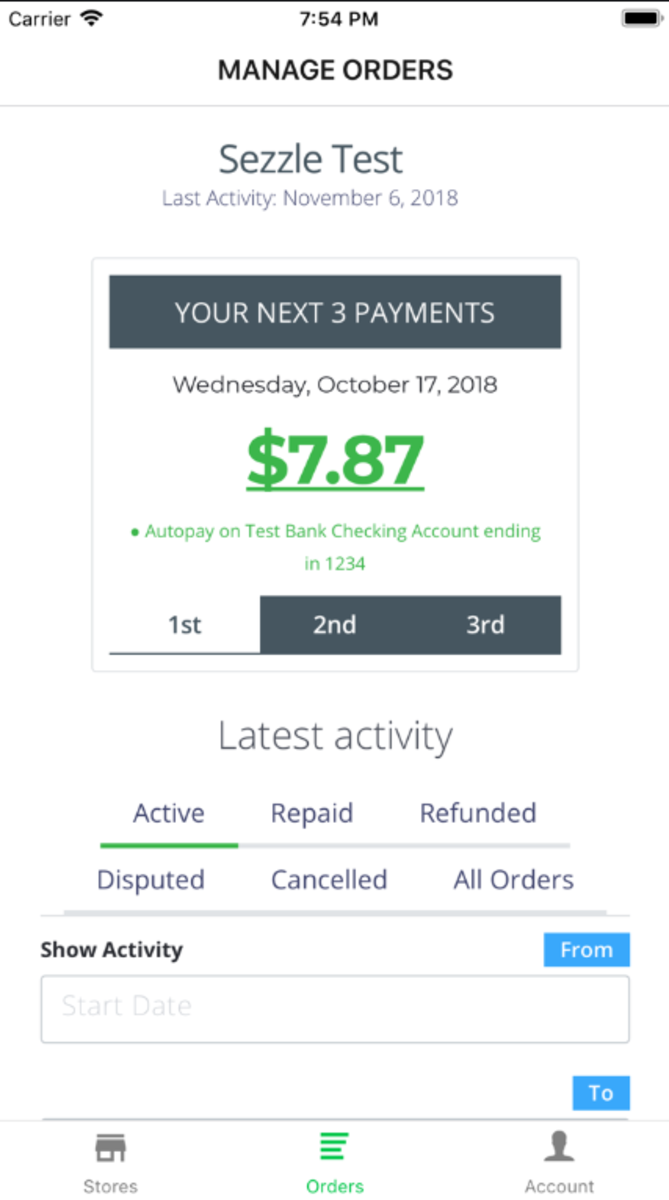

2. Sezzle

Sezzle has enjoyed increasing popularity over the last couple of years. Their success can be attributed to their fast approval process, which involves performing soft credit checks on their users. As soon as your account is verified, you’ll receive an approval decision, and then you can start shopping right away. Take note that even if you’re rejected, your credit score wouldn’t be affected. With Sezzle, you’ll have to pay the first installment at checkout and the remaining three installments every two weeks.

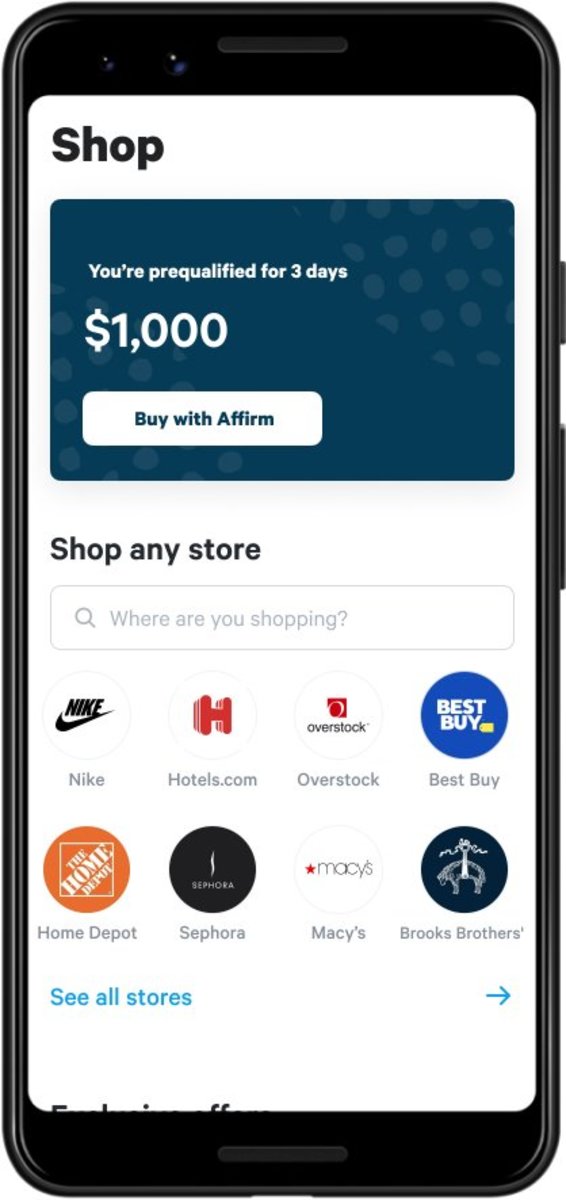

3. Affirm

You may have seen Affirm after purchasing from popular stores including Walmart, Wayfair, and Casper. The company has expanded its services by partnering with thousands of offline and online retailers. And users love the fact that there’s no minimum credit score to qualify. A soft credit check is necessary to get approved. According to the company, their average customer takes out a $750 loan and pays the full amount at 18% APR in nine months. That’s a pretty sizeable amount for an online loan provider, making Affirm an excellent alternative to Klarna for larger purchases.

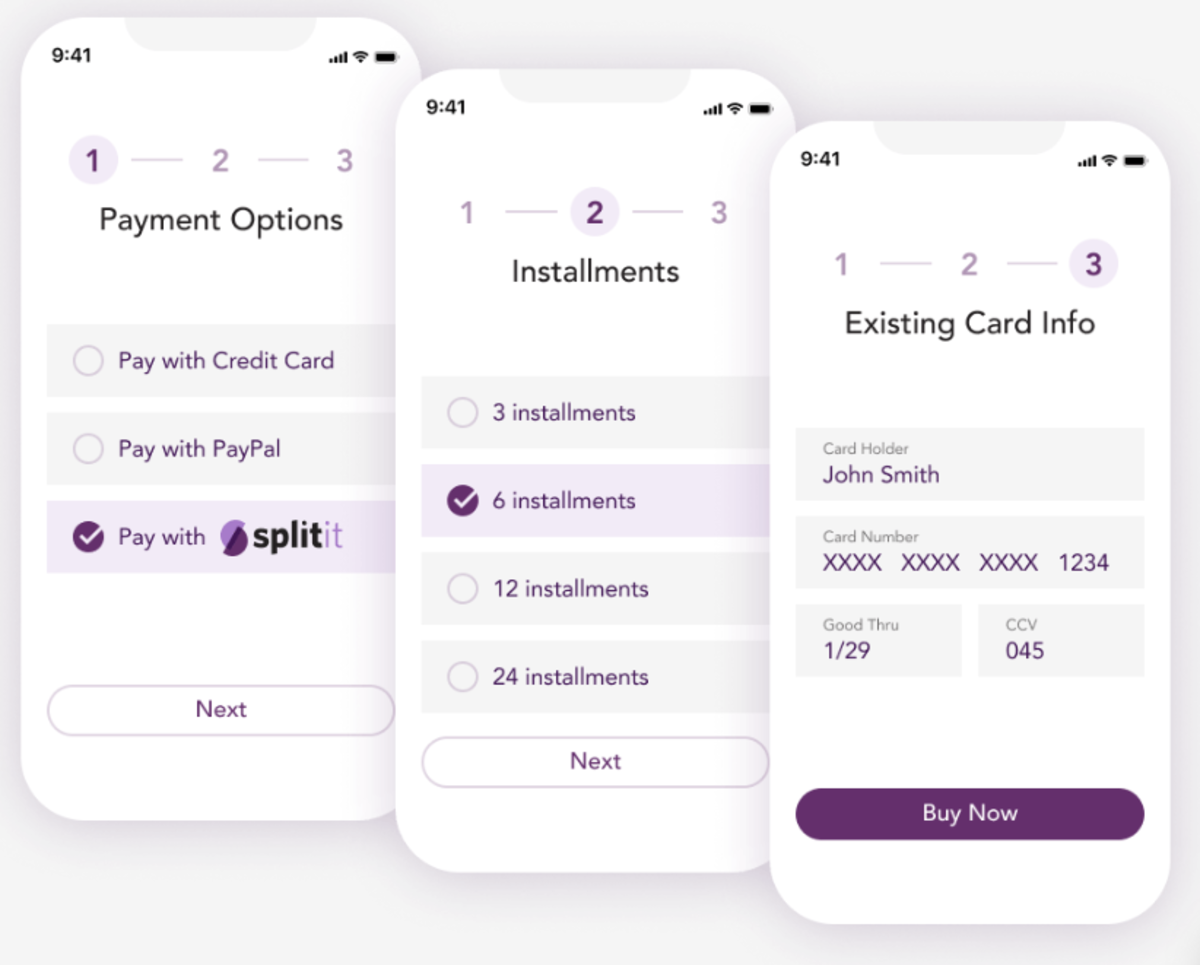

4. Splitit

Splitit makes the buy now pay later service more accessible because users don’t need to apply for a line of credit with the company. You can use your existing Mastercard or Visa credit or debit card to make purchases and pay them in installments. When buying from one of their partner vendors, you can choose Splitit as a payment option and the number of installments you want to repay to the total cost of your purchase. These installments are taken automatically from your card once a month. For debit cards, the maximum purchase is set at $400.

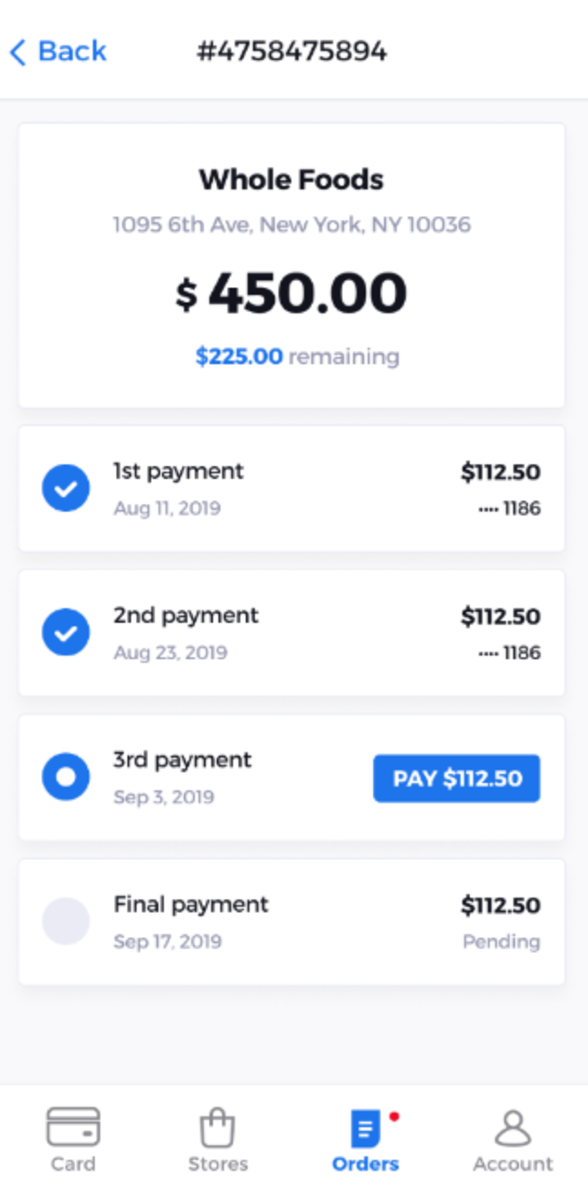

5. Quadpay

Several things make Quadpay a great substitute to Klarna. For one, it allows you to split the purchase price into four equal payments. Soft credit checks are performed every time you use the service, and the fast approval decision means you can shop with minimal fuss. But unlike most of the shopping apps on this list, Quadpay can impact your credit rating when you fail to make timely payments. Perhaps this is a good thing though as it teaches you the importance of paying credit and avoiding interest and other fees.

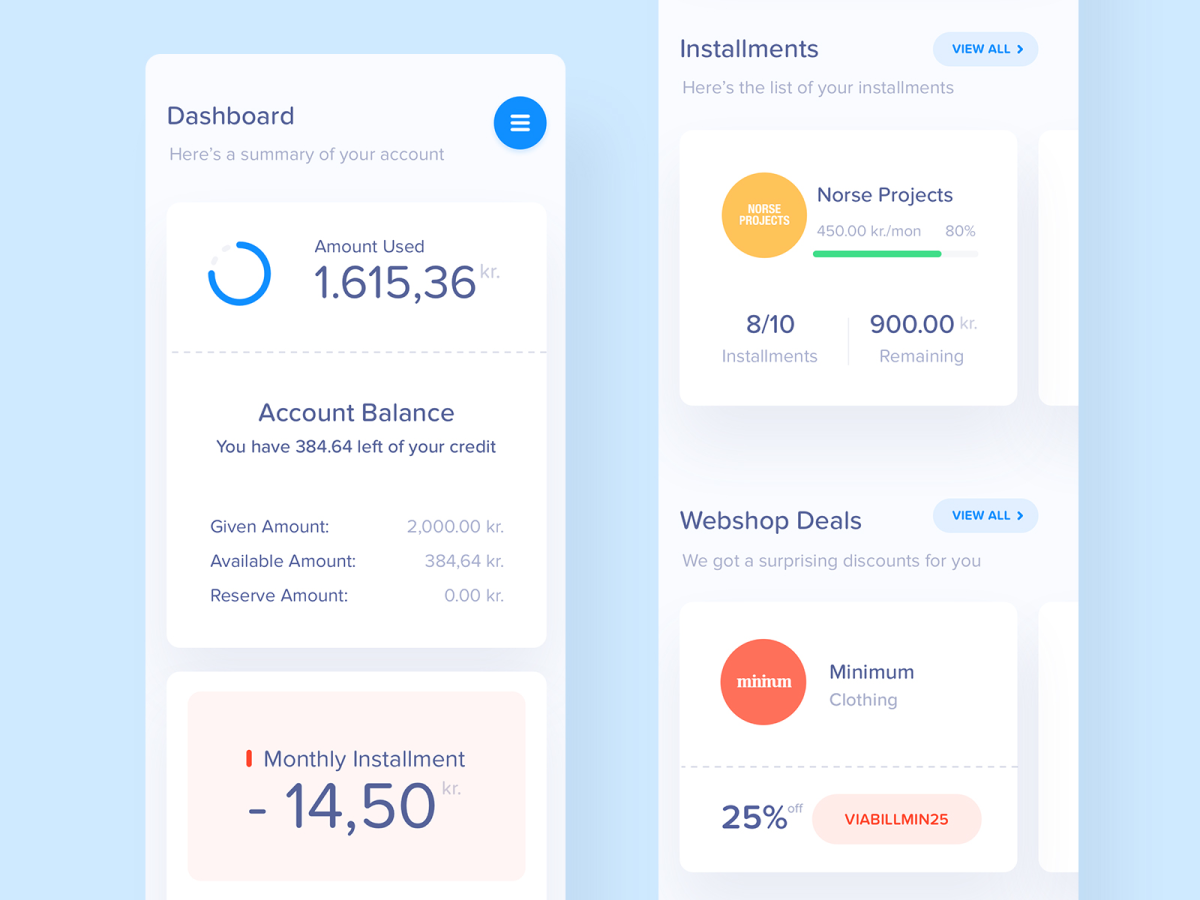

6. ViaBill

ViaBill is available as a payment option in over 5,500 websites. You need to enter some personal information such as your email address, phone number, credit or debit card number to get approved at checkout. Note that the approval happens in real-time. Once approved, you can make 4 equal monthly installments, with the first one paid at the point of purchase. ViaBill is similar to Klarna, but it doesn’t require any credit checks. Moreover, you don’t have to worry about interest at all.

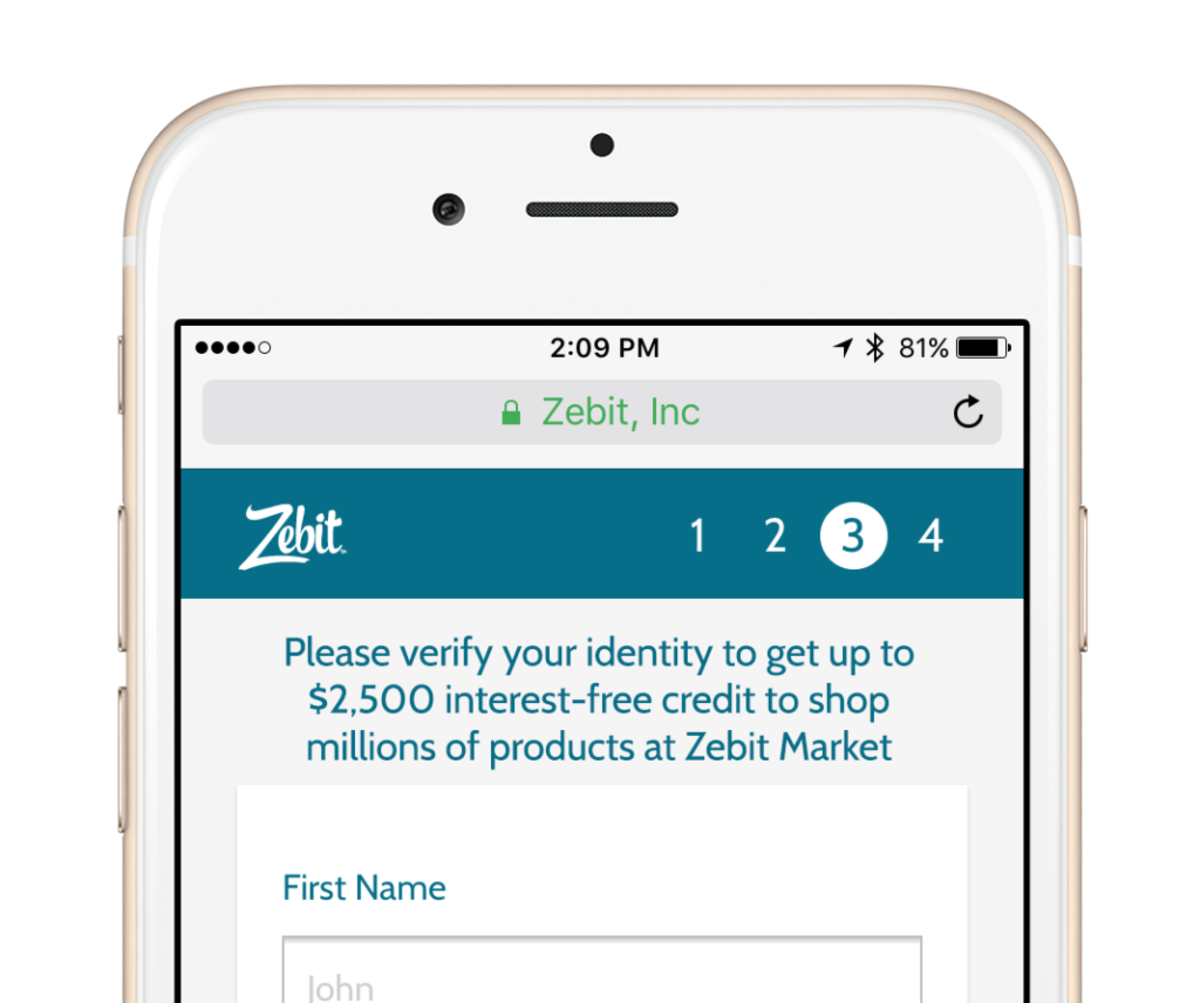

7. Zebit

Zebit boasts of more than 3 million users, and you just might be their next loyal customer. What’s great about Zebit is that it offers you the chance to take out a $2,500 interest-free credit. That’s a whopping amount that should be more than enough for your shopping needs. To qualify, you must be over 18 years old, must be actively employed or retired with benefits. Zebit means it when they say they don’t charge interest and membership fees.

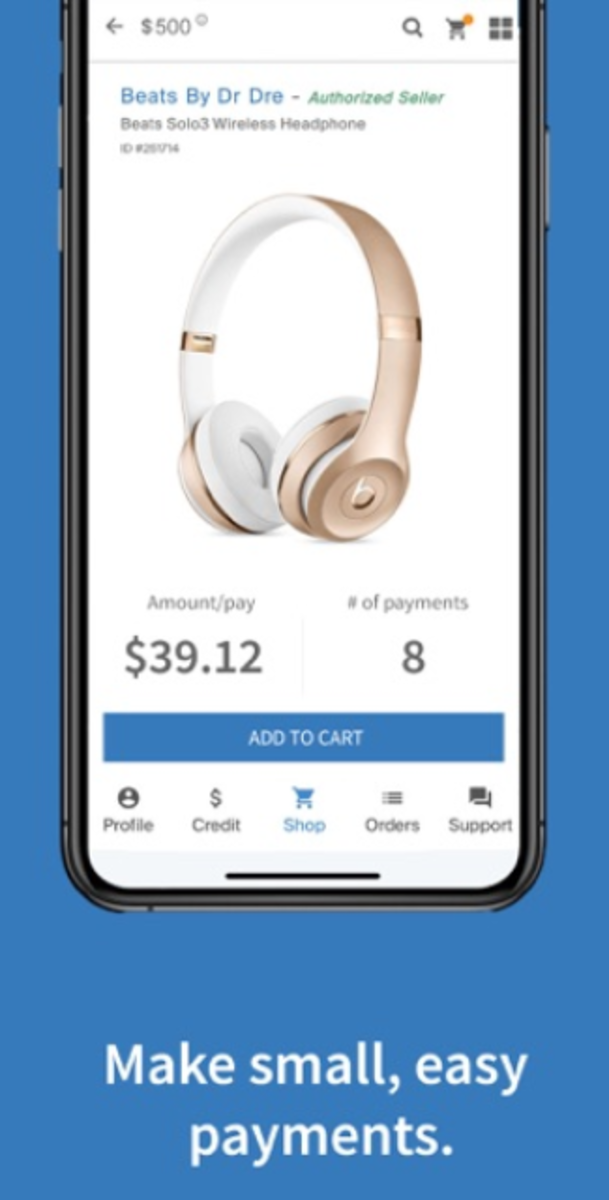

8. Perpay

Perpay is as easy as payment solutions get. After signing up, you’ll be asked a few questions to determine your Spending Limit, which ranges from $500 to $2,500. You can then start browsing their marketplace consisting of thousands of popular brands. A direct payroll deposit is required to make your purchase, and the installments will be deducted from your future paychecks. This means you don’t need to worry about missed payments. Your Spending Limit increases as you continue using the platform.

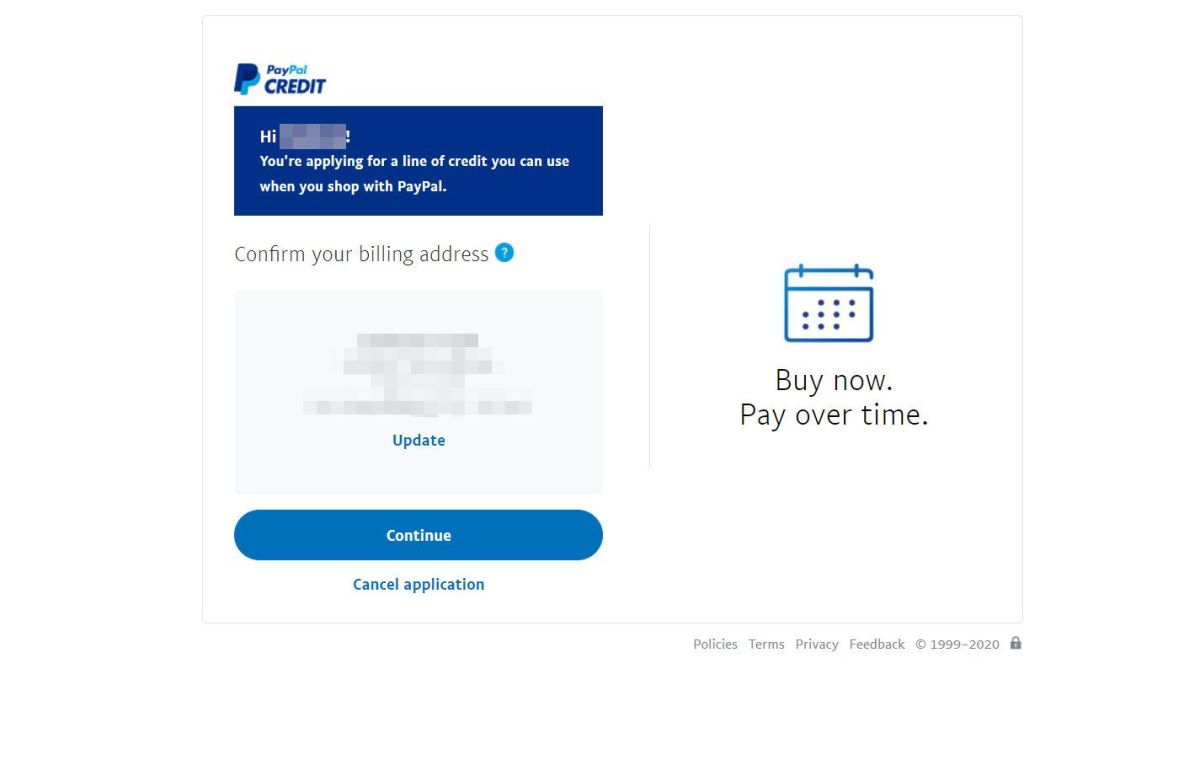

9. PayPal Credit

You’ve probably used PayPal at one point or another to send or receive payments. PayPal Credit is a new service in which you can get a revolving credit card that provides you with a reusable credit line integrated into your PayPal account. You can use your credit line to make online purchases and pay the full cost over time. If you use PayPal regularly, then this is an attractive option. But the steep interest rates might be a turn off for many people. For purchases worth $99 or higher, however, you won’t be charged any interest if you pay the full amount in 6 months.

Be Responsible When Using Shopping Apps

Keep in mind that buy now pay later shopping apps could be either helpful or harmful. It’s tempting to purchase items that go beyond your financial capabilities, but these apps can help by enabling you to make small, monthly payments. Just be careful not to fall into a vicious debt cycle, especially when using shopping apps that can affect your credit score. Be responsible whenever you use these apps to guarantee a fantastic shopping experience while keeping your finances healthy.